Lawcus – New Features September 2025

25th September 2025

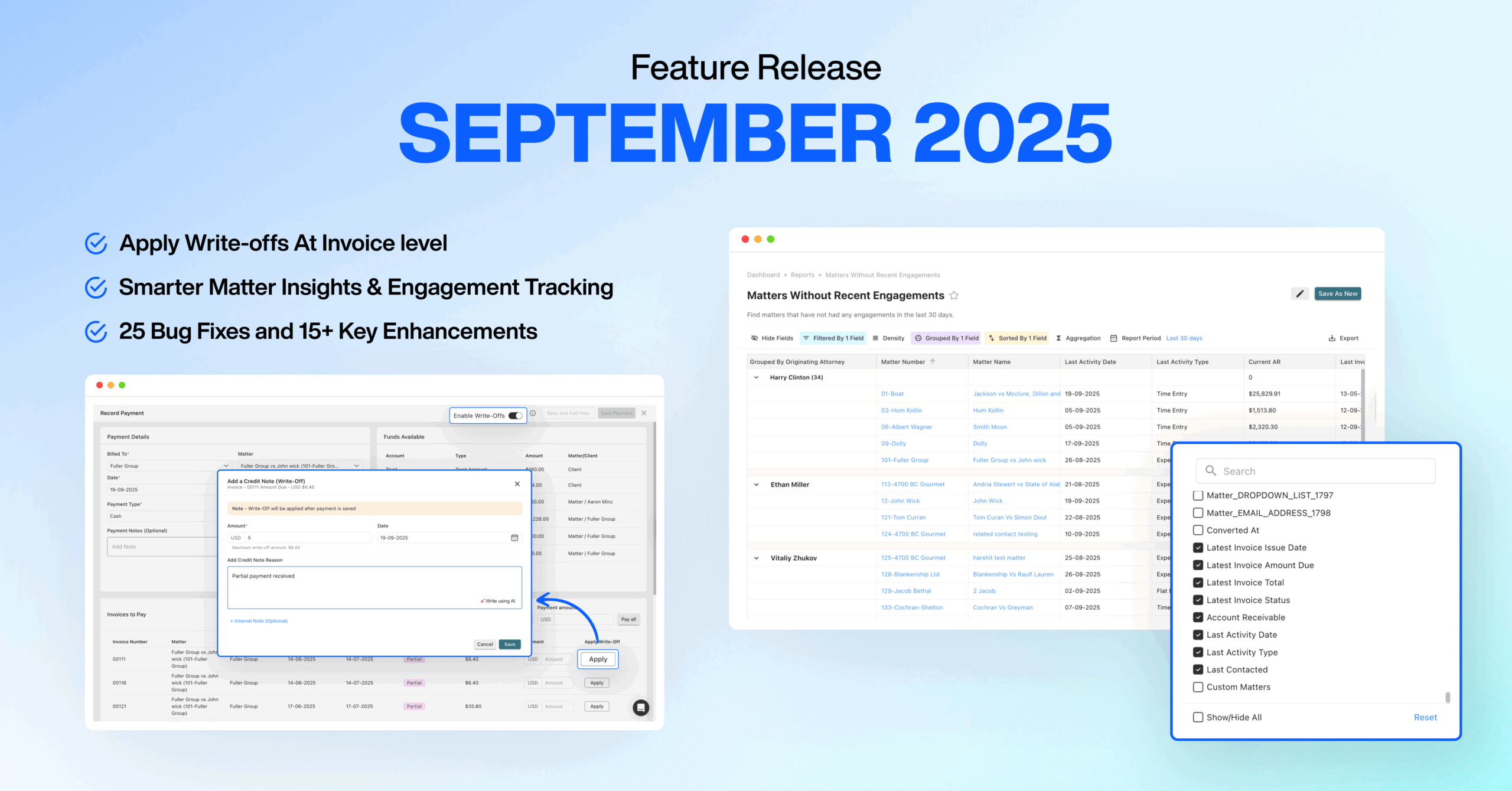

- Apply Write-Offs with Payments: You can now apply write-offs while recording a payment. This removes the need to make separate adjustments and keeps invoice balances accurate immediately.

- Matter Insights and Engagement Tracking: Matters now show Latest Invoice Status, Accounts Receivable as of today, and Last Contacted. A new report lists matters with no activity in the last 30 days.

- Workflow Enhancements for Trust and Credit: Workflows now support trust and credit requests. New options allow you to disable reminders and skip approvals when needed.

- Tax Calculation for Workflow Invoices: Invoices created through workflows can now calculate taxes using the assigned invoice template. A new “Apply Taxes” option controls whether tax is applied.

- Bulk Delete Activities: Admins and Owners can now delete multiple activities at once. Only uninvoiced activities can be deleted to protect billing records.

- Disable Reminders on Trust and Credit Requests: Trust and Credit Request forms now include a Disable Reminder option. This prevents automatic reminder notifications when not needed.

Read More

Wisetime

Wisetime